So, what exactly is food truck equipment financing? Think of it as a specialized business loan or lease, tailor-made to help you get all the necessary kitchen gear for your truck without having to pay for everything at once. It's the secret weapon for launching a mobile kitchen in a competitive market like ours, freeing up your cash for all the other startup costs.

This way, you can get your hands on those crucial commercial refrigerators, commercial freezers, and cooking appliances right now, all while making predictable, manageable monthly payments.

Launching Your Food Truck Dream in Las Vegas

Picture this: you're slinging your signature tacos or gourmet burgers with the glittering Las Vegas Strip as your backdrop. This vibrant city is home to a diverse array of restaurants that cater to every palate, creating a 24/7 food scene that is a goldmine for mobile kitchens. From tourists on Fremont Street to locals in Henderson, Las Vegas was built on a love for exciting food, and a properly equipped food truck can become a local legend almost overnight.

But there's always one big hurdle standing between your culinary vision and opening day: the staggering cost of professional equipment. Outfitting a food truck isn't just about buying a vehicle; it's about building a legit, high-performance kitchen on wheels. This is where food truck equipment financing becomes your most valuable player.

Powering Your Mobile Kitchen

Financing is the bridge that gets you from a great idea to a fully functioning business. Instead of blowing your entire startup fund on expensive gear, you can get brand-new, top-of-the-line assets and pay them off over time. This keeps your cash liquid for other non-negotiables like permits, inventory, and getting the word out.

For a successful launch here in Vegas, certain pieces of equipment are essential for success. Your must-have list is going to include:

- Commercial Refrigerators: Absolutely essential for keeping ingredients fresh in that relentless Nevada heat.

- Commercial Freezers: You'll need these for long-term storage, which lets you buy ingredients in bulk and save money.

- Ice Machines: A total non-negotiable for serving up ice-cold drinks to thirsty customers.

Taking a smart approach to acquiring this gear is more critical than ever. The food truck industry is absolutely booming in the United States, on track to become a USD 1.59 billion market by 2031. That kind of rapid growth means that for operators in a hot market like Las Vegas, smart financing for reliable equipment isn't just an option—it's a necessity for survival.

At the end of the day, financing isn't just a loan; it's a growth strategy. It lets you invest in high-quality, dependable equipment from day one, which is the foundation for an efficient and successful operation. Before you can ever serve a single customer, your kitchen has to be thoughtfully planned out. To get a better idea of how it all comes together, check out our guide on effective food truck design to see how every piece of equipment fits into the bigger picture.

Your Guide to Food Truck Financing Options

Stepping into the world of food truck equipment financing can feel like trying to read a complicated menu in a new language. You see all these terms—loans, leases, advances—and it’s easy to get overwhelmed. But just like a great recipe, the key is breaking it down into simple, understandable parts.

Think of financing as a tool. It gets you the high-performance gear you need now—like commercial refrigerators and freezers—while letting you pay for it over time. This keeps your cash free for all the other stuff: permits, inventory, and marketing, which are absolutely critical here in Las Vegas.

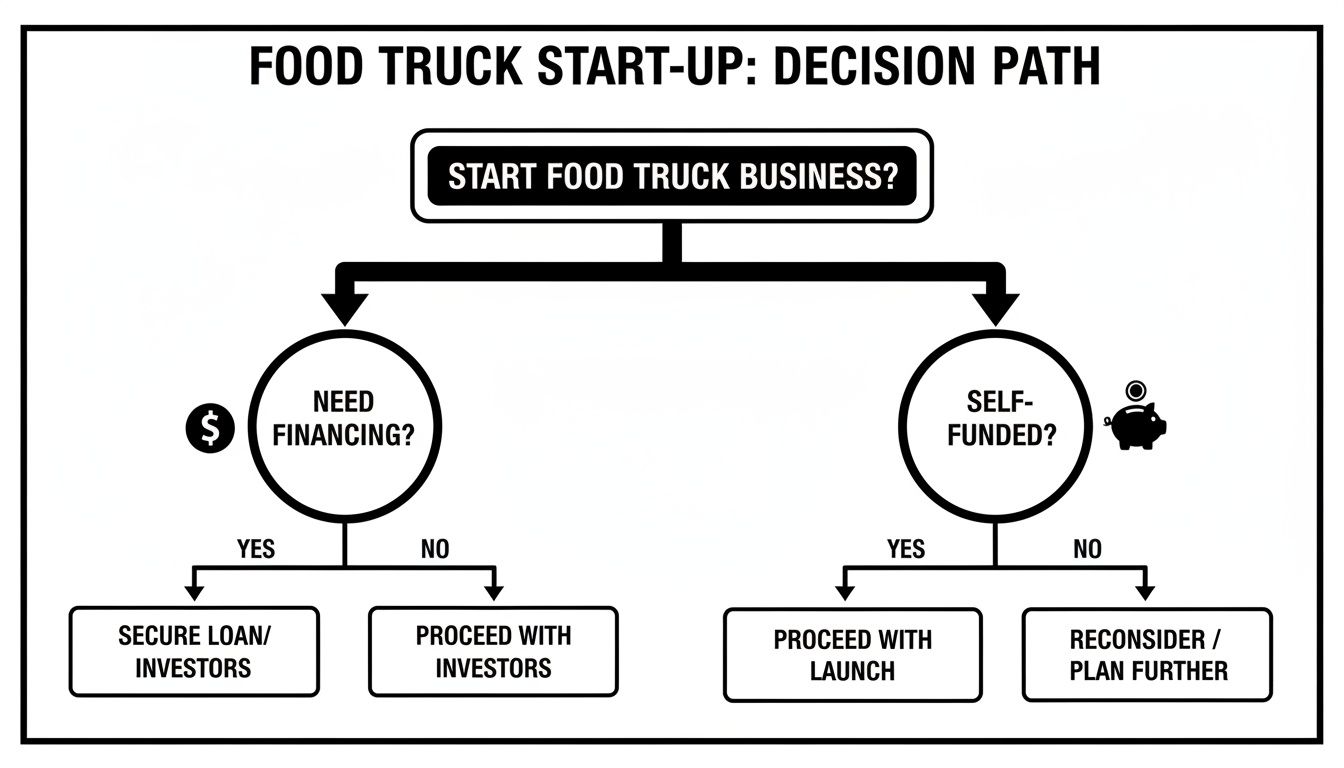

This decision tree gives you a quick visual on where to start, depending on whether you're using your own capital or looking for outside funding.

It really just boils down to those two main paths. Let's dig into what they mean for your mobile kitchen.

Equipment Loans: The Path to Ownership

An equipment loan is about as straightforward as it gets. It works a lot like a car loan: you borrow a set amount to buy your equipment and make fixed monthly payments. Once you’ve paid it all off, that commercial ice machine or griddle is 100% yours.

This is the perfect route if you’re confident in your equipment choices and want to build long-term assets for your business. When you own your gear, you can modify it, sell it, or even use it as collateral down the road.

Equipment Leases: Flexibility for the Future

If a loan is like buying a house, an equipment lease is like renting an apartment. You pay a monthly fee to use the equipment for a set period, usually a few years. When the lease is up, you generally have a few choices: send it back, renew the lease, or buy the gear for its current market value.

Leasing is a fantastic strategy if you want to keep your kitchen modern or if you're still testing your concept in the competitive Vegas food scene without a huge upfront commitment. The monthly payments are often lower, too.

A huge plus for both loans and leases is that the equipment itself usually serves as the collateral. This makes them way more accessible than traditional bank loans that might ask you to put up personal assets.

Other Funding Avenues to Consider

Beyond the two main roads of loans and leases, a few other options can help you outfit your mobile kitchen. Each one serves a different purpose for different situations.

- SBA Loans: Backed by the Small Business Administration, these loans often have great interest rates and longer repayment terms. They’re competitive and you’ll need a solid business plan, but they are an incredible resource for well-prepared startups.

- Merchant Cash Advance (MCA): An MCA isn’t really a loan—it's an advance on your future sales. A lender gives you cash now in exchange for a slice of your daily credit card sales until it's paid back. It's fast, but it can be one of the more expensive options.

- Vendor or "Owner" Financing: Sometimes, the equipment supplier you're buying from will offer their own financing programs. This can really simplify the process since you're dealing directly with them. It's also worth it to explore owner financing options as another creative way to acquire what you need.

The right choice really depends on your business goals, your cash flow, and where you see your truck in a few years.

To make things a bit clearer, here's a side-by-side look at the most common financing methods for food truck entrepreneurs in Las Vegas.

Comparing Food Truck Financing Methods

| Financing Type | Best For | Ownership | Typical Approval Time |

|---|---|---|---|

| Equipment Loan | Building long-term assets and owning equipment outright. | You own the equipment after the loan is fully paid. | 1-5 business days |

| Equipment Lease | Lower monthly payments, flexibility, and upgrading to new tech. | The leasing company owns it; you have a purchase option. | 1-3 business days |

| SBA Loan | Startups with strong business plans seeking low rates. | You own the equipment. | Several weeks to months |

| Merchant Cash Advance | Needing fast cash when traditional options aren't available. | You own the equipment. | 24-48 hours |

| Vendor Financing | A streamlined, one-stop-shop purchasing experience. | Varies; can be a loan or a lease structure. | 1-3 business days |

Ultimately, weighing the pros and cons of each path against your specific needs will help you land on the perfect financial partner for your food truck journey.

Your Essential Las Vegas Food Truck Equipment Checklist

Okay, you've got your food truck equipment financing plan in place. Now for the fun part: turning that cash into the hard-working gear that will bring your menu to life. Setting up a kitchen on wheels here in Las Vegas isn't like anywhere else. You're building for speed, high volume, and a desert heat that doesn't quit. This equipment isn't just a bunch of appliances; it's the heart of your business. Every single piece has to be tough, efficient, and up to code.

This list covers the absolute must-haves for any serious Las Vegas food truck. Whether you're planning to serve the late-night crowds on the Strip or cater a private event out in Summerlin, you need equipment that can keep up.

The Cold Line: The Foundation of Freshness

In the middle of a Nevada summer, great refrigeration isn't a luxury—it's your first line of defense. It's what keeps your food safe, your ingredients fresh, and your customers happy. A big chunk of your financing will go here, and trust me, it’s not the place to cut corners. Your coolers and freezers are the silent workhorses running 24/7.

You'll want to look for high-performance, NSF-certified models built to handle the bumps and vibrations of a mobile kitchen. Grabbing an energy-efficient unit is also a smart move for the long haul; it'll ease the strain on your generator and save you money on fuel.

- Commercial Refrigerator: A solid single or double-door reach-in is non-negotiable for holding prepped items, sauces, and produce. Estimated Cost: $2,000 - $5,500.

- Commercial Freezer: This is essential for stocking up on proteins, bread, and other frozen goods, which helps you control food costs and manage your inventory. Estimated Cost: $2,500 - $6,000.

- Sandwich Prep Table: A true game-changer for speed. It's a refrigerated base with a cooled rail on top, keeping all your taco, salad, or sandwich toppings perfectly chilled and right where you need them. Estimated Cost: $2,000 - $4,500.

- Ice Machine: You can't operate in Las Vegas without one. From sodas to signature drinks, a dependable ice machine means you'll never have to turn away a thirsty customer. Estimated Cost: $1,500 - $4,000.

The Hot Line: Where the Magic Happens

This is where your menu comes alive. The cooking equipment you pick directly impacts how fast you can serve, how good your food tastes, and what you can even offer. Versatility is the name of the game in a city with such diverse tastes.

Investing in quality cooking equipment from the start prevents costly downtime and repairs. A broken fryer during a lunch rush isn't just an inconvenience—it's lost revenue and a hit to your reputation.

Here are the essentials for a powerful and flexible hot line:

- Commercial Griddle (Flat-Top): This is the MVP for so many food trucks. It's perfect for smashing burgers, flipping pancakes, searing cheesesteaks, and grilling veggies. You get a huge, consistent cooking surface. Estimated Cost: $800 - $3,000.

- Deep Fryer: A commercial deep fryer is a guaranteed crowd-pleaser, whether you're making french fries or crispy chicken. Look for one with a fast recovery time so you can keep up with a constant stream of orders. Estimated Cost: $700 - $2,500.

If you want to dig deeper into outfitting your mobile kitchen, check out our complete food truck equipment list for more ideas and specs. And don't forget to protect these critical assets. It's a smart idea to look into adding equipment breakdown insurance to your business policy. It provides that extra peace of mind, so you can focus on building a resilient kitchen ready to take on the Las Vegas food scene.

How to Build a Winning Financing Application

Securing financing for your food truck equipment isn't just about filling out paperwork; it's about telling a compelling story. Lenders in Las Vegas have seen it all, and they need to see that your business is more than a passion project. They want to back a viable, well-planned operation that’s ready to make a name for itself in this city’s electric food scene. A winning application frames you as a reliable, high-potential investment.

Think of your application as the business plan for the loan itself. It needs to be professional, crystal clear, and supported by solid numbers. This is your one shot to prove you've done the homework and truly understand what it takes to run a profitable mobile kitchen here in Vegas.

Gathering Your Essential Documents

Before you even think about approaching a lender, you need to get your financial toolkit in order. Having everything organized and ready to go from the start shows you're a professional and makes the whole process faster and smoother for everyone involved. It’s exactly like doing your mise en place before the dinner rush—proper prep guarantees a flawless execution.

Here are the core documents your application package absolutely must include:

- A Detailed Business Plan: This is your roadmap. It needs to spell out your food truck concept, who you're targeting in Las Vegas, how you'll market to them, and what makes you different from the truck parked a block away.

- Realistic Financial Projections: Lenders live and breathe numbers. You'll need projected profit and loss statements, cash flow forecasts, and a solid break-even analysis for at least the first three years.

- Personal and Business Credit History: Be ready to share your credit scores. While getting equipment financing is often easier than a traditional bank loan, a strong credit history will always open doors to better terms and higher approval chances.

- Official Equipment Quotes: Don't just estimate. Get professional quotes for the specific gear you plan to finance, whether it's commercial refrigerators, freezers, or high-capacity ice machines. This shows you're serious and have done your research.

Crafting a Compelling Business Narrative

Your business plan is so much more than a document—it's your pitch. This is where you connect all the dots for the lender, showing them exactly how your food truck will not just survive but thrive in the unique Las Vegas market. Don't just rattle off facts; build a narrative that gives them confidence in you.

Start by getting specific about your niche. Are you planning to be the go-to for gourmet late-night bites near the casinos? Or will you be serving healthy lunches to the professional crowd out in Summerlin? A focused concept is always more believable than a generic one. Show them you get this city's diverse tastes and have a real plan to serve a specific slice of it.

Equipment financing has really become a cornerstone for food truck startups. It lets new operators get their hands on essential commercial kitchen gear—like sandwich prep tables, charbroilers, and merchandiser coolers—without burning through all their startup cash. This is more relevant than ever, with the global equipment finance market expected to grow from $1,437.04 billion in 2025 to $1,591.37 billion in 2026. Lenders often focus on the assets themselves, like Atosa freezers and ranges, using the equipment as collateral. This makes it less risky for them and easier for you to get approved. You can dive deeper into this by reading a comprehensive guide about food truck financing.

Presenting Yourself as a Low-Risk Investment

At the end of the day, lenders are just evaluating risk. Your job is to present yourself as a safe, profitable bet. This boils down to showing you're financially responsible and have a deep understanding of how your business will work.

The most successful applications don't just ask for money; they demonstrate a clear path to repayment. Lenders invest in operators who have a firm grip on their numbers and a realistic plan for generating revenue from day one.

Showcase any industry experience you or your team brings to the table. If you've worked in restaurants or managed a small business before, make sure you highlight it. That kind of background immediately lowers the perceived risk.

Finally, just be transparent and honest. If there's a weak spot in your application, like a less-than-perfect credit score, address it head-on. Explain what happened and what steps you're taking to move past it. A little confidence mixed with a lot of honesty goes a very long way.

Seeing the Numbers: A Real-World Financing Example

Talk about percentages and financial terms can feel a little abstract. So, let's bring food truck equipment financing down to earth with a real-world scenario right here in Las Vegas. This vibrant city is packed with an incredible array of restaurants, from high-end dining to quick-service gems, and the one thing they all need is reliable equipment.

Imagine you're launching "Vegas Vegan Bites," your new food truck dream, serving up delicious plant-based comfort food. You’ve crunched the numbers and know you need a solid equipment package to get rolling.

This example will help you see exactly how financing can turn those abstract numbers into a tangible budget.

Building Your Essential Kitchen Package

Your goal is to secure $25,000 to outfit your truck with the workhorses of any mobile kitchen. This is the amount you need for the non-negotiable items that will keep you running smoothly in the desert heat, focusing on essential refrigeration and cooking power.

Here’s a realistic breakdown of what that financing could cover:

- Commercial Refrigerator: A high-performance, two-door Atosa unit to keep your fresh produce and plant-based proteins perfectly chilled.

- Commercial Freezer: An undercounter freezer to store bulk items like veggie burgers and fries, saving crucial space and money.

- High-Capacity Fryer: Absolutely essential for those crispy, crowd-pleasing sides that are a must for any comfort food menu.

- Versatile Griddle: A 36-inch flat-top griddle for searing your signature vegan patties and toasting those buns to perfection.

This package gives you the core functionality to execute your menu efficiently and safely. For a deeper dive into budgeting for these items, check out our guide to understanding restaurant startup costs.

Visualizing Your Loan Repayments

Okay, now let's see how financing that $25,000 package actually plays out. Let’s say you’ve secured a standard 5-year (60-month) equipment loan with a competitive interest rate. This amortization table breaks down how your payments chip away at the loan, year by year.

The key takeaway from an amortization schedule is seeing how your payments shift over time. Initially, a larger portion goes toward interest. As you progress, more of each payment goes toward the principal, building your ownership stake in the equipment.

This visual breakdown makes it clear: your $507 monthly payment becomes a predictable, manageable operating expense.

Sample Food Truck Equipment Loan Amortization ($25,000)

Here’s a look at how that $25,000 loan breaks down over five years.

| Year | Beginning Balance | Total Payments | Principal Paid | Interest Paid | Ending Balance |

|---|---|---|---|---|---|

| 1 | $25,000.00 | $6,083.88 | $4,400.34 | $1,683.54 | $20,599.66 |

| 2 | $20,599.66 | $6,083.88 | $4,795.50 | $1,288.38 | $15,804.16 |

| 3 | $15,804.16 | $6,083.88 | $5,233.19 | $850.69 | $10,570.97 |

| 4 | $10,570.97 | $6,083.88 | $5,717.85 | $366.03 | $4,853.12 |

| 5 | $4,853.12 | $6,083.88 | $4,853.12 | $146.88 | $0.00 |

| Total | $30,419.40 | $25,000.00 | $5,419.40 |

As you can see, the total interest paid over the five years is $5,419.40. Think of this as the cost of borrowing—it’s the price for getting your essential equipment now and generating revenue immediately, instead of waiting years to save up the full amount.

This example turns a big number like $25,000 into a manageable monthly investment, making your Las Vegas food truck dream feel that much more achievable.

Common Questions About Food Truck Financing

Let's be honest, jumping into the world of food truck equipment financing can feel a bit overwhelming, especially here in a city like Las Vegas that moves a million miles an hour. You've got questions about credit scores, funding speed, and all the little details in between. Getting straight answers is the first step to getting your truck on the road with confidence.

The culinary scene here is no joke, and being prepared is half the battle. So, let's dive into the questions we hear most often from aspiring food truck owners just like you.

What Credit Score Do I Need for Financing?

This is probably the number one question on everyone's mind. The good news? Equipment financing isn't as rigid as a traditional bank loan. Why? Because the equipment itself—that shiny new commercial freezer or that workhorse of a griddle—acts as the collateral for the loan.

Of course, a higher credit score will always get you a better interest rate, but you don't need a perfect 800 to get approved. Many lenders are happy to work with new business owners with scores starting in the low 600s. This flexibility opens the door for a lot more entrepreneurs to get their start in the competitive Las Vegas food scene.

Can I Finance Used Equipment?

You can, but it’s often more of a headache. Lenders get a little nervous about used gear because it's out of warranty, doesn't hold its value as well, and you just don't know its history. In a town that truly never sleeps, you can't risk your main refrigerator giving out during a Friday night rush.

Opting for new, warranty-backed equipment isn't just about easier financing—it's an investment in your peace of mind. A brand-new commercial refrigerator or ice machine is far less likely to fail during a critical dinner rush, protecting your revenue and reputation.

When you buy new from a trusted supplier, you're not just getting better financing terms. You're getting the assurance that your kitchen can handle whatever the hungry Las Vegas crowds throw at it, without a costly breakdown stopping you in your tracks.

How Long Does the Approval Process Take?

Here's where equipment financing really shines: speed. A traditional bank loan can feel like it's moving at a snail's pace, sometimes taking weeks or even months. In a fast-moving market like this, opportunities don't wait around that long.

With specialized equipment financing, the whole process is built for speed. Once you submit all your documents, like your business plan and the quotes for the equipment you need, you can often get an answer in just 24 to 48 hours. That kind of quick turnaround means you can get your gear, build out your truck, and get on the road serving customers while your idea is still hot.

Ready to turn your food truck dream into a reality? At Las Vegas Restaurant Equipment, we offer straightforward financing options to help you get the new, reliable equipment you need to succeed. Explore our selection and get started today at https://lasvegasrestaurantequipment.com.